Who We Are

$10B+

Capital Previously Managed by Principals

50+

Years of Alternatives Investing By Principals

200+

Transactions Closed By Principals

21

Countries with Local Representation

Our Approach

Our Values

Transparency

Transparency

Objectivity

Objectivity

Fairness

Fairness

Integrity

Integrity

Deep Dive

Deep Dive

Bias for Action

Bias for Action

Stewardship

Stewardship

Proactive

Proactive

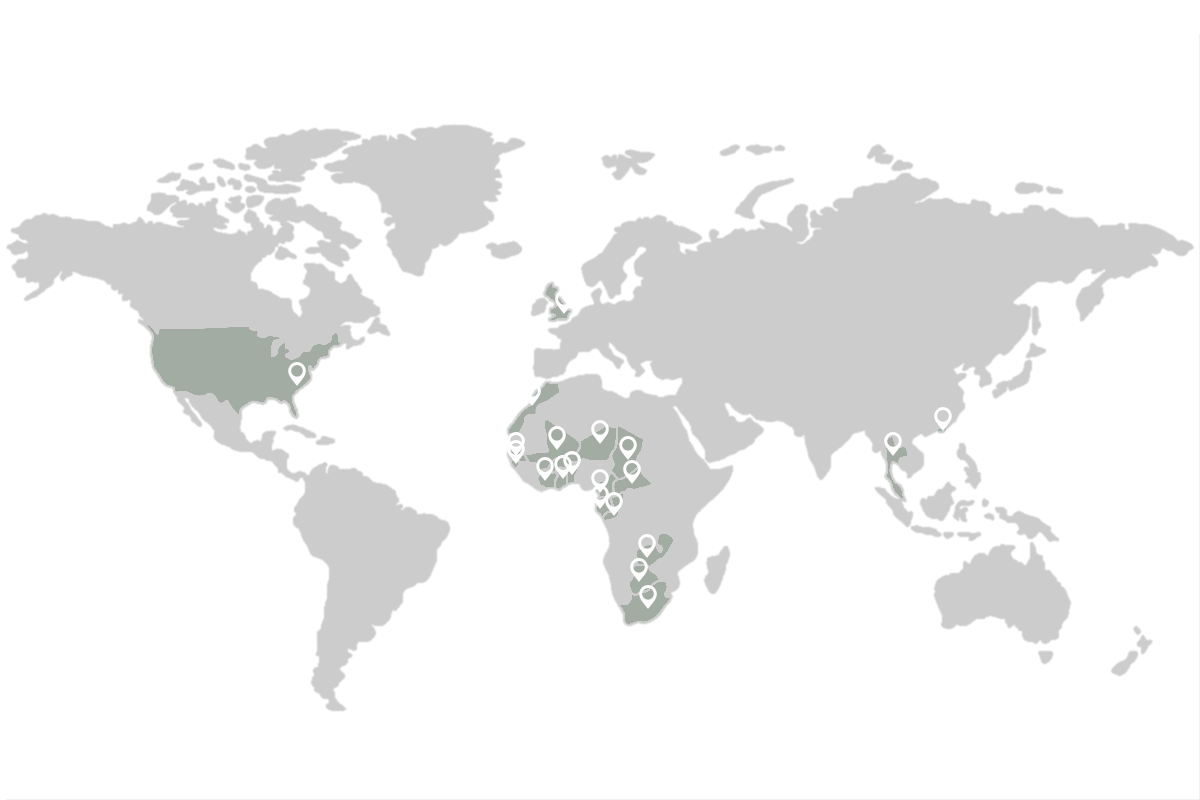

Our Global Presence

Hong Kong

Bangkok

London

Washinton D.C

Morocco

Morocco

Burkina Faso

Côte d'Ivoire

Ghana

Niger

Chad

Cameroon

Gabon

Congo

Zambia

Botswana

South Africa

Our Strategic Partners

Our Board of Advisors

Adnate Capital strategically aligns with partners who exemplify the highest standards of integrity, ensuring our processes are conducted with unparalleled transparency and trustworthiness.

Christopher Mvunga

Former Governer of The Central Bank of Zambia

We strive to create value for clients and sponsors in the middle market.

Unlocking Value Across Diverse Markets

We deliver tailored investment solutions with a focus on private credit, real estate, and venture capital. Our extensive market analysis and due diligence uncover opportunities that generate substantial returns, ensuring success for our stakeholders.

Dynamic Market Adaptation

We continuously refine our strategies to stay ahead in the ever-evolving global markets. By leveraging cutting-edge technology, we enhance operational efficiency, offering our clients innovative and cost-effective access to sophisticated investment opportunities.

A Culture of Integrity & Partnership

At the core of Adnate Capital is a team committed to integrity, collaboration, and knowledge sharing. These values foster long-term partnerships and trust, allowing us to navigate complex financial landscapes with agility and foresight.

Responsibility

Innovative Strategies, Sustainable Growth

Recent News & Insights

Instinct vs. Metrics: The Case for Data-Driven Credit Investing Over Gut Feel

In the complex world of credit markets, there is a persistent truth that may unsettle some of Wall Street’s old guard: deep analysis and disciplined

Market Caution: Are Fed Cut Expectations Too Optimistic?

Investors have been quick to recalibrate their expectations following the Federal Reserve’s recent pivot towards monetary easing. The Fed’s shift from aggressive rate hikes to

Coverage Ratios Begin to Ease

Over the past 18 to 36 months, the Federal Reserve’s shifting policies have significantly impacted interest coverage ratios within the investment-grade credit space. From March

Adnate Journal

Instinct vs. Metrics: The Case for Data-Driven Credit Investing Over Gut Feel

In the complex world of credit markets, there is a persistent truth that may unsettle some of Wall Street’s old guard: deep analysis and disciplined strategy often trump the most seasoned instincts. While many fund managers tout their years in the business as a badge of honor and a mark of market wisdom, it’s worth asking if this experience always holds up when markets shift,

Market Caution: Are Fed Cut Expectations Too Optimistic?

Investors have been quick to recalibrate their expectations following the Federal Reserve’s recent pivot towards monetary easing. The Fed’s shift from aggressive rate hikes to cuts, aimed at softening economic pressures and fostering growth, has buoyed market sentiment. However, this enthusiasm may be premature, as markets appear to be pricing in a steeper trajectory of rate cuts than is prudent given the current economic environment.

Coverage Ratios Begin to Ease

Over the past 18 to 36 months, the Federal Reserve’s shifting policies have significantly impacted interest coverage ratios within the investment-grade credit space. From March 2022 to September 2024, the Fed’s aggressive rate hikes, aimed at curbing inflation, led to increased borrowing costs and higher interest expenses for corporations. As a result, many investment-grade companies experienced a decline in their ability to meet interest obligations.